The European debt crisis has rekindled long-standing debates about the power of finance and the fraught relationship between capitalism and democracy in a globalized world. Why Not Default? unravels a striking puzzle at the heart of these debates—why, despite frequent crises and the immense costs of repayment, do so many heavily indebted countries continue to service their international debts?

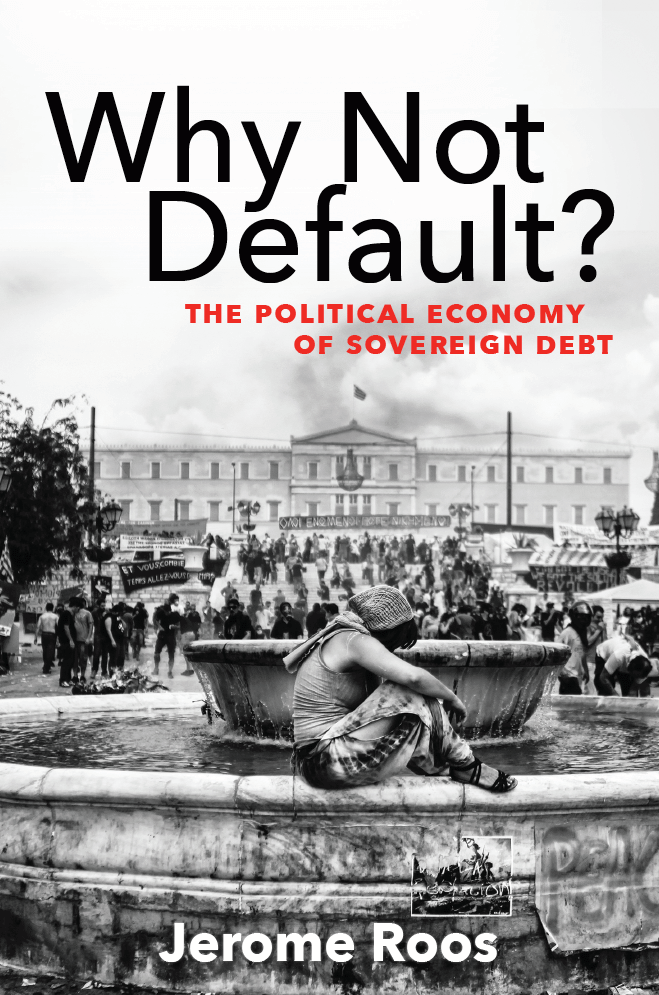

In this compelling and incisive book, Jerome Roos provides a sweeping investigation of the political economy of sovereign debt and international crisis management. He takes readers from the rise of public borrowing in the Italian city-states to the gunboat diplomacy of the imperialist era and the wave of sovereign defaults during the Great Depression. He vividly describes the debt crises of developing countries in the 1980s and 1990s and sheds new light on the recent turmoil inside the Eurozone—including the dramatic capitulation of Greece’s short-lived anti-austerity government to its European creditors in 2015.

Drawing on in-depth case studies of contemporary debt crises in Mexico, Argentina, and Greece, Why Not Default? paints a disconcerting picture of the ascendancy of global finance. This important book shows how the profound transformation of the capitalist world economy over the past four decades has endowed private and official creditors with unprecedented structural power over heavily indebted borrowers, enabling them to impose painful austerity measures and enforce uninterrupted debt service during times of crisis—with devastating social consequences and far-reaching implications for democracy.

Contents:

Introduction. The Sovereign Debt Puzzle

PART I. THE THEORY OF SOVEREIGN DEBT

Chapter 1. Why Do Countries Repay Their Debts?

Chapter 2. A Critical Political Economy Approach

Chapter 3. The Structural Power of Finance

Chapter 4. Three Enforcement Mechanisms

PART II. A BRIEF HISTORY OF SOVEREIGN DEFAULT

Chapter 5. The Making of the Indebted State

Chapter 6. The Internationalization of Finance

Chapter 7. From Great Depression to Financial Repression

PART III. THE LOST DECADE: MEXICO (1982–1989)

Chapter 8. Syndicated Lending and the Creditors’ Cartel

Chapter 9. The IMF’s “Triumphant Return” in the 1980s

Chapter 10. The Rise of the Bankers’ Alliance

Chapter 11. “The Rich Got the Loans, the Poor Got the Debts”

PART IV. THE GREAT DEFAULT: ARGENTINA (1999–2005)

Chapter 12. The Exception That Proves the Rule

Chapter 13. From IMF Poster Child to Wayward Student

Chapter 14. The Rise and Fall of the Patria Financiera

Chapter 15. “Even in a Default There Is Money to Be Made”

PART V. THE SPECTER OF SOLON: GREECE (2010–2015)

Chapter 16. The Power of Finance in the Eurozone

Chapter 17. Anatomy of a “Holding Operation”

Chapter 18. The Establishment Digs In

Chapter 19. The Socialization of Greece’s Debt

Chapter 20. The Defeat of the Athens Spring

Conclusion: Shaking Off the Burden

A fascinating and timely book! Gives us a whole new perspective on the global debt crises since the 1980s.

Jeremy Adelman, Princeton UniversityAdvance praise for Why Not Default?

This is an outstanding book. Jerome Roos demonstrates how the structural power of creditors has grown, enabling them to impose demands on countries regardless of political system, partisan composition, or the nuances of different interest groups.

Peter A. Gourevitch, UC Santa Barbara

This is a fascinating and timely book! It gives us a whole new perspective on the global debt crises since the 1980s. To understand why countries grind through under duress and the power of finance, we need to understand why struggling borrowers don’t give up. Why do have-less countries continue to borrow despite the massive transfers to have-more countries and investors? This book offers brilliant insights.

Jeremy Adelman, Princeton University

Why Not Default? is a must-read for all those wishing to truly understand the current challenges to democracy and social justice. In this meticulously and thoroughly researched book, Roos shows how the transformation in the global economy has resulted in the reconfiguration of both international and domestic power relations, producing a formidable set of incentives and constraints that compel nations to repay their debts even when the social costs are unbearably high.

Judith A. Teichman, University of Toronto

In this engaging book, Jerome Roos hones in on three mechanisms that militate against sovereign default: market discipline, policy conditionality, and national elites within the debtor country. The 1-2-3 punch of international banks, multilateral institutions, and domestic capitalists overwhelms tendencies to default, which is why default is such a rare event in the contemporary world. This book is an important contribution to understanding structural power in the international political economy.

Pepper D. Culpepper, University of Oxford

The four decades since the breakdown of the Bretton Woods order (early 1970s) have seen a frequency of foreign debt crises at least twice as high as in the decades before 1914—yet with hardly any sovereign debt defaults, while such defaults were almost normal through the nineteenth century up to the 1930s. Why this dramatic change? Jerome Roos provides us with surprising answers, which explain why foreign investors in the contemporary era have been so confident of repayment despite the lack of effective legal enforcement mechanisms on indebted governments. As he does so, he breathes fresh understanding into the whole field of the political economy of international finance.

Robert H. Wade, London School of Economics